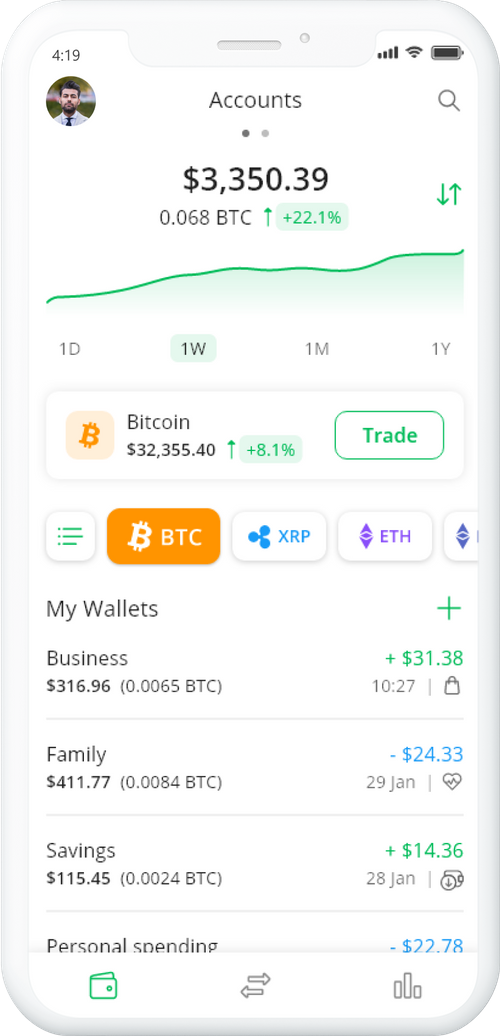

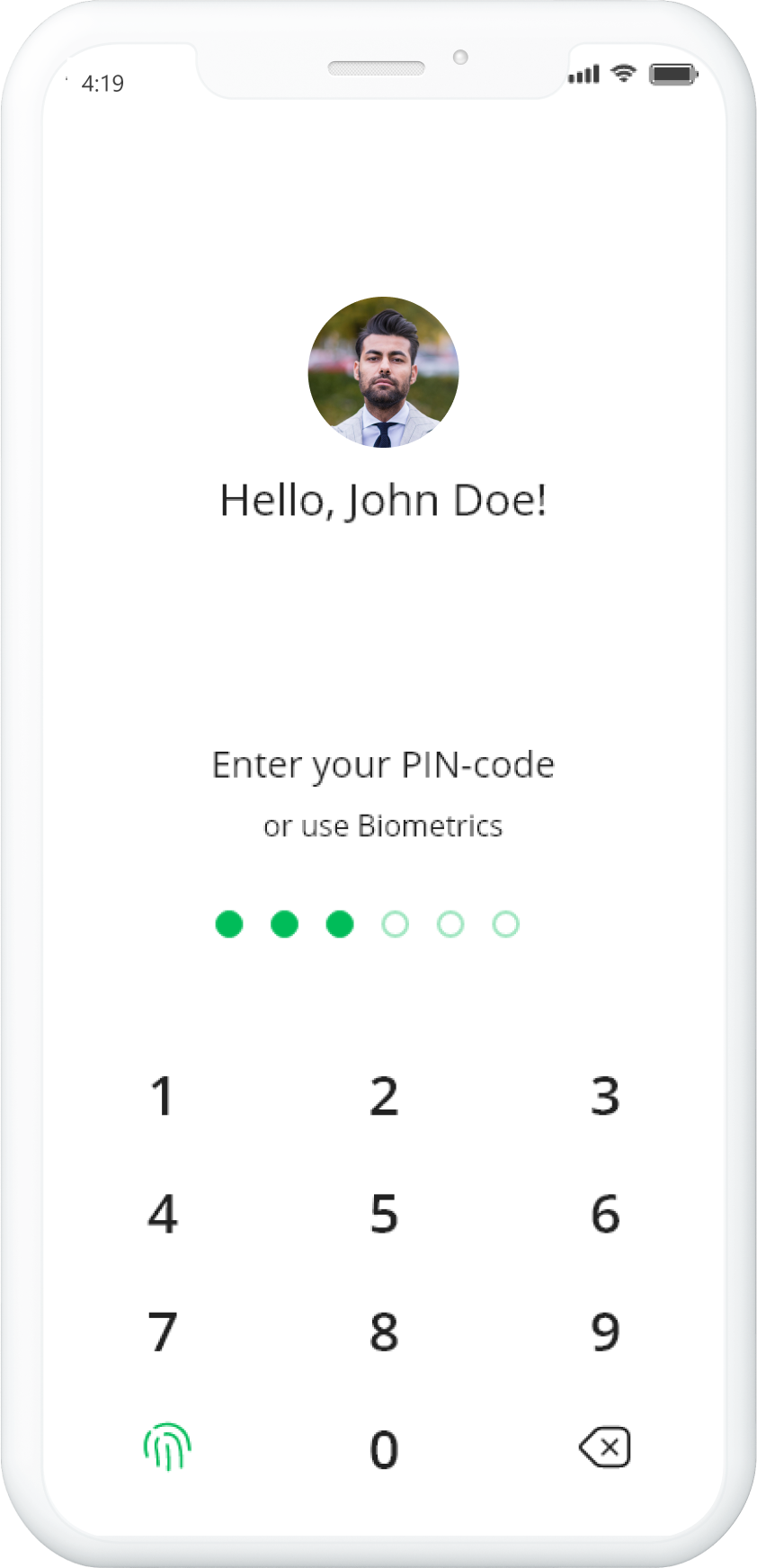

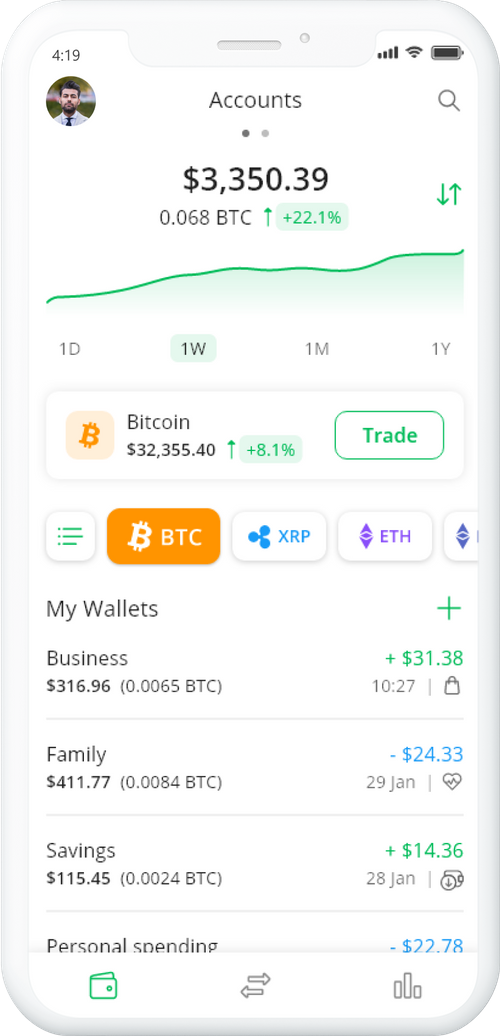

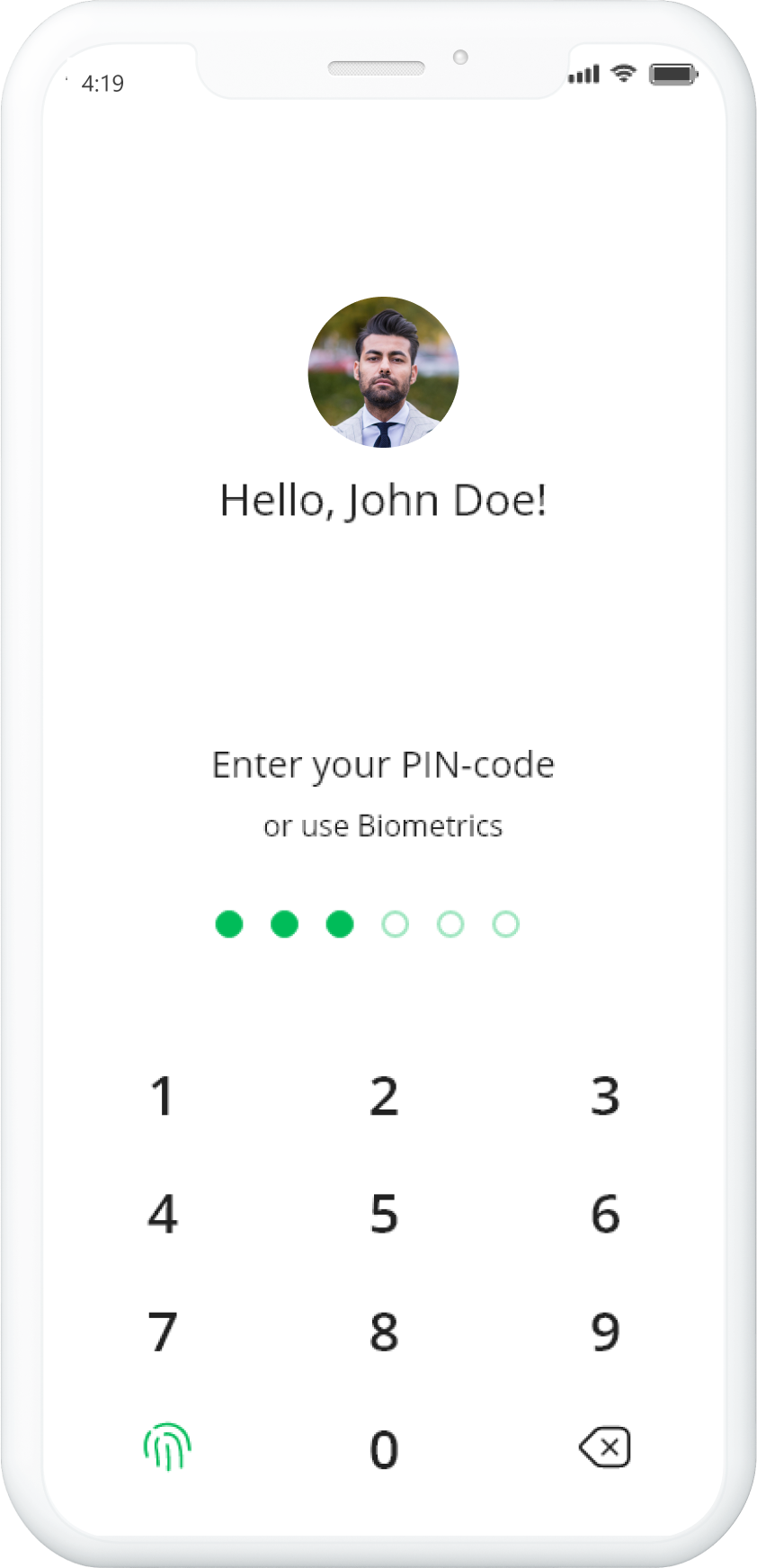

Try Payperless -

our crypto mobile wallet.

The easiest way to manage Your Crypto - no need to be an expert! It takes minutes to get started.

Saturday & Sunday: Closed

Crypto OTC trading or over-the-counter exchange of cryptocurrencies and Bitcoin involves a private transaction to buy or sell a large amount of BTC, ETH, etc. OTC crypto trading provides increased privacy for both buyers and sellers, making OTC exchange desks secure and safe, especially when it comes to large amounts of cryptocurrencies.

OTC crypto trading is the process of buying and selling crypto assets directly between two individuals or companies. In this process, in addition to the OTC broker who provides the OTC trading process, there are 2 parties involved - one of which wants to sell a large amount of cryptocurrency at a certain price, and the other party wants to buy Bitcoins in large quantities at a certain price. When the parties agree on the price, there is a direct exchange or sale of cryptocurrencies.

The direction of crypto OTC exchange can be different - cryptocurrency to cryptocurrency - for example, BTC to ETH, or exchange of fiat money to cryptocurrency (or vice versa) - for example, USD to BTC, or ETH to USD. All of these transactions take place through crypto OTC desks - which are professional trading platforms that work directly with buyers and sellers of cryptocurrencies.

Buying or selling large amounts of cryptocurrencies is a complicated process that is not always easy to accomplish through online exchanges, and the commission for such a transaction can be very high. If you want to buy or sell an amount of 500 BTC, it will be difficult to get the whole amount at once through one order. Most likely, you will not be able to exchange such an amount of cryptocurrency at one price; it will take a significant amount of time to complete the order, and crypto-market price fluctuations will affect the cost of assets.

Such a problem has been solved through the creation of OTC crypto-trading platforms, where you can use an OTC broker to buy or sell any amount of BTC on a single order without much complexity.

Over-The-Counter trading is a decentralized trading operation that facilitates private deals for buying or selling crypto. These transactions take place on private exchanges. Their records are not on public order records. OTC trading increases privacy for the trading partners. It also provides low impact current cryptocurrency market prices.

An OTC Desk conducts over-the-counter (OTC) trades with its clients. Instead of matching buyers and sellers, the OTC Desk will act as a dealer for anybody looking to trade a given asset. Generally, this trading option comes into play when trades are not possible on public exchange platforms. This trade may be because the asset in question is not available for trading on these public exchange platforms. The OTC desk becomes the intermediary between the dealers who want to either buy or sell the particular asset.

There are practical steps you should consider taking to start trading crypto like Bitcoin over the counter. Below are some of the practical steps that you typically have to engage in to proceed with trading crypto over the counter:

Step 1: Choose an OTC brokering platform: Paydepot OTC desk - is a reputable OTC trading solution. This option provides seamless OTC trading features that make your crypto trading function easier and faster.

Step 2: Terms and Conditions: The types of crypto you choose to trade, your trading conditions, how trade occurs, among several others, are what you set here. Specify what type of cryptocurrency you want to trade, the number of crypto-asset you wish to trade, when you want the trade to take place, and your desired price.

Step 3: Negotiation and Agreement: You cannot achieve a trade without the other party accepting the terms and conditions for trade. When the counterpart responds with his or her terms and an agreement on price and other terms is reached, value exchange can occur. This stage may also include a KYC (Know Your Customer) activity by the desk and other involved parties.

You should be aware that there are two-fold primary risks you should be aware of while you are trying to enter the OTC trading market. The first is the amount of information about the trading company. OTC trades take place on private exchange platforms. Because of these two primary concerns, the SEC warns against association with companies that do not provide adequate information about their organization nor have enough representation. There is also the risk associated with the type of crypto-assets that the OTC market trades. For these reasons, traders are advised to be careful when picking OTC desks.

OTC trading does not affect the price of cryptocurrencies. This is because the crypto trade action is done in private. It does not trigger a mass buy or a mass dump like public buying and selling does in most cases. The null effect on public market prices is one of the several benefits that OTC offers to the market. Large trades can happen offline without having a direct impact on the price and volatility of the crypto market.

The OTC desk aims to source the crypto that the buyer wants and sell it to the buyer at a slightly higher price. When the terms of sale are agreed upon by the buyer, the desk looks for an average price that is favorable to their initial quote. The OTC desk takes off the difference between the initial quote and the buyer. While this strategy almost guarantees a profit for the OTC desk, there are fewer losses as crypto price volatility might spike the quote after the OTC deal is made.

Over-the-counter deals are bi-directional contracts involving two parties setting and agreeing to terms and conditions concerning trades between these parties. It also entails how these trades are to be settled in the future. This deal type is different from a centralized exchange. This process involves the trading of securities through a private broker-dealer network, involving securities that might not be traded on public platforms.

Over-the-counter trading qualifies as an exchange as two parties directly participate in the trade of commodities. Although OTC trading is not a formal exchange option like the NYSE, nor does it have a physical location, it offers a decentralized market that allows buyers and sellers to transact directly with one another over the internet.

Over-the-counter trading of BTC involves the buying and selling of the agreed (usually large) amount of BTC without affecting the public market and avoids creating crypto market volatility. OTC private trading allows the trading of crypto assets directly between a buyer and seller. This trade might be a direct swap of different cryptocurrencies or trade cryptocurrency for traditional currency. These private OTC trading activities are facilitated by crypto OTC desks.

Crypto OTC desks are private trading intermediaries that make trades that are not possible on public exchanges happen. This is a decentralized solution that connects both buyers and sellers of certain cryptocurrencies to exchange choice assets while agreeing to set terms and conditions. OTC desks are the go-to decentralized exchanges for certain trades that are not possible on public exchanges. For seamless transactions, OTC desks are representative for buyers and sellers engaging in a deal.

Crypto Over-The-Counter trade is a private exchange between buyers and sellers. It involves OTC desks as moderators for this trade for a fair and seamless exchange of currencies. Because these transactions are private, there are no public records for these trades. This provides privacy for both buyers and sellers. It also provides assets in demand that may not be available on public platforms to interested buyers.

Crypto OTC trading involves the direct swapping of crypto assets between two parties. There is the OTC platform that facilitates this decentralized trade. Some terms and conditions border these decentralized trades to facilitate a fair and seamless exchange.

You can participate in Over-the-counter (OTC) crypto trading by choosing an OTC desk that you can trust. A splendid OTC trade desk you can trust is paydepot.com as it offers seamless trading services. Request for a quote for the quantity of cryptocurrency that you wish to sell. You can proceed to negotiate and agree on a suitable price to trade your crypto asset.

You can buy bitcoin over-the-counter. Over the counter crypto trading is an alternative to the global financial trading market operation. It decentralizes the formal exchange operation you might be used to via a public platform while allowing you to buy large amounts of Bitcoin or other crypto assets. To buy Bitcoin over the counter, you can approach OTC desk brokers of your choice that attends to your needs. Paydepot.com is an outstanding OTC broker that provides seamless services for your every crypto need.

The easiest way to manage Your Crypto - no need to be an expert! It takes minutes to get started.