Trading is not for everyone. Some people like to buy and hold, collect dividends, or passively receive cryptocurrencies without worrying about short-term dips that occasionally happen in the market. If you're looking for a new way to earn passive income with the coins you already own, you might want to consider staking your cryptocurrency.

However, it's essential to understand how to stake your cryptocurrency and what coins are the best to earn passive income. In this article, we'll cover the best staking crypto in 2021-2022 to help you earn passive income with your coins.

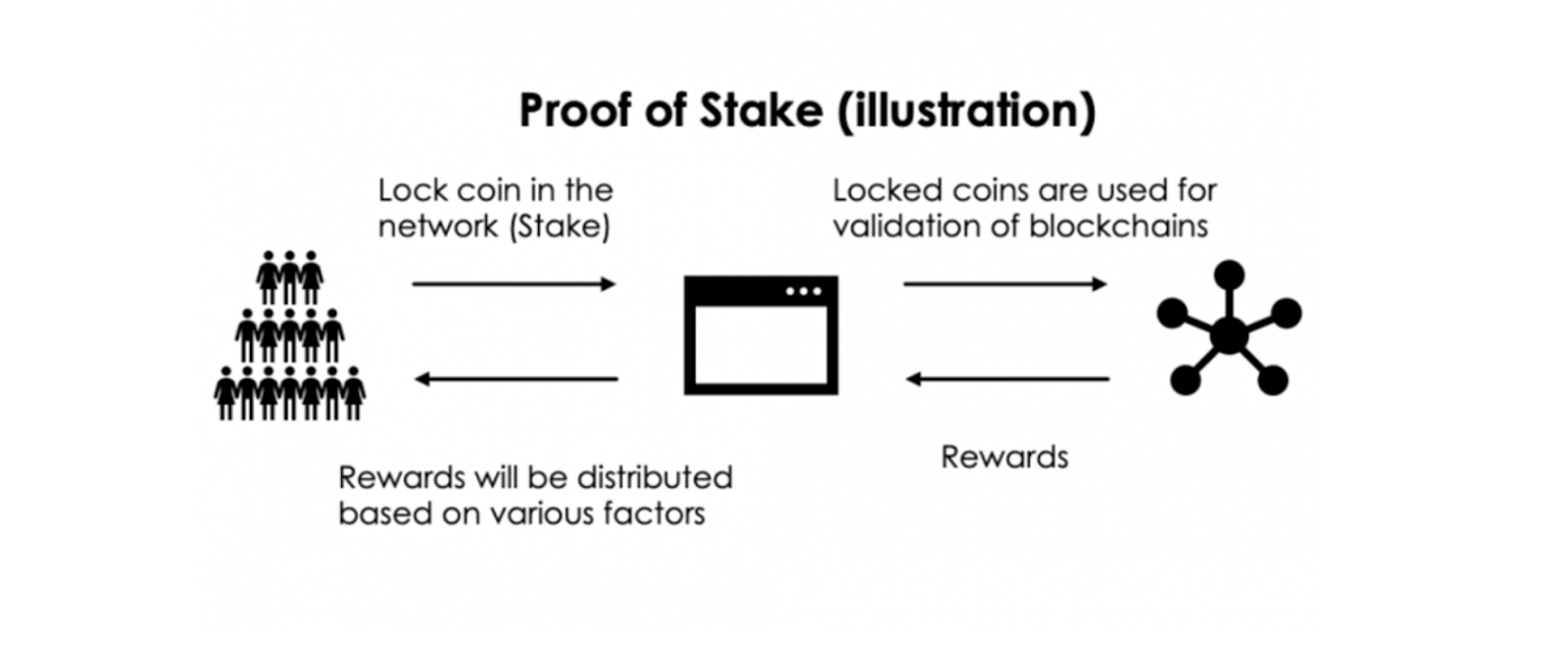

What Is Proof of Stake?

Proof of stake is a consensus mechanism that is far different from the proof of work mechanism on which Bitcoin and Ethereum rely. In a proof of stake system, cryptocurrency owners can validate transactions by putting their coins down as collateral for their chance to be rewarded with transaction fees and/or newly minted coins. This process significantly reduces the amount of work that needs to be done in order to verify transactions and verify blocks to keep crypto secure.

How Does Staking Work?

The exact staking process varies from one cryptocurrency to another, but the general idea is the same for most cryptocurrencies. Once you've committed your coins to a staking wallet, they start accumulating compound interest in what are known as "blocks" in most cryptocurrencies.

It's important to note that you'll still have possession of the coins that you stake when you stake them. Therefore, if you want to unstake your coins, you're free to do so at any time. However, this may be different for your specific case depending on the stake you signed up for and how long you agreed to stake them.

Staking Rewards

Every time a block is added to the blockchain, the validator of the block will receive the staking rewards, which are typically new cryptocurrency coins. Typically those rewards will mirror the same crypto that you're initially investing. So, for example, if you are staking Cardano, you'll typically receive rewards in the form of more Cardano.

How Are Staking Rewards Calculated?

Staking rewards are typically calculated through a combination of different inputs put together, such as:

- Time: How long you've committed to staking

- Transactions Per Second (TPS): This is the number of transactions that blocks can process per second. The higher this number, the more TPS your system supports, which usually correlates to a higher reward for your efforts.

- Coin Age: The longer your coins have been in staking, the higher your coin age will be and the larger reward you'll receive for each block.

On top of this, you're likely going to receive higher rewards on a higher value coin. Depending on the platform you use, you'll typically find a fixed rate for calculating rewards which is why it's so important to research each platform before committing to one for your staking needs.

What Is Staking Coins?

Staking coins is a set of cryptocurrencies that you can use to earn passive income without actively trading or engaging in any other type of activity. Of course, you'll still have access to all of your funds at the time that they were staked, so if you want to unstake them, you're free to do so whenever you decide.

Staking vs. Mining

If you've been involved in cryptocurrency for any length of time, you have probably heard the terms staking and mining used interchangeably. However, mining is a completely different concept from staking. When cryptocurrencies are mined, they're created on a blockchain network through a process called mining. In a proof of work system, miners work to find blocks on the blockchain, which are sets of transactions added together. When a miner finds a block, they get to keep the transaction fees associated with it. As an extra incentive, miners are usually given coins for finding blocks as well.

When it comes to staking cryptocurrency, you're not mining at all! You're committing your coins to help secure the network, not mining new coins. In fact, you could say that staking is a much more passive way of earning cryptocurrency because it doesn't require any work on your part other than committing your funds to a staking wallet and leaving it alone until the time that you decide to unstake them.

Pros and Cons of Staking Crypto

Advantages

Staking has many distinct advantages over other ways to earn cryptocurrencies. The first and most obvious advantage is that it's completely hands-free, which means you can simply stake your funds and leave them alone until the time comes to unstake them. This makes staking an excellent way to make passive income without actively trading or engaging in other types of cryptocurrency earning activities. There are also no specific requirements to earn staking rewards, which have a much lower barrier to entry than mining usually does. All you'll need is the wallet address for the particular coin you want to stake and enough of that coin to cover your transaction fees. This means that it will be much easier for you to stake coins that are new on the market.

Disadvantages

Staking does come with some rather significant disadvantages, however. The first is that there's no guarantee of staking rewards at all, which can be very discouraging for some investors. As more people begin to see the potential earning of staking coins, the competition to earn staking rewards will increase dramatically. This will push the number of people who are able to earn staking rewards down further, meaning you'll need to stake more in order to see an impact on how much you make.

Plus, you'll have to stop trading the cryptocurrency that you've staked, which can be problematic if you're trying to make a profit. If the cryptocurrency market begins to drop, you won't want to stop trading it because you'll miss out on some excellent short-term opportunities for making money. Instead, you'll end up having to wait until your staking rewards are available before you can get back into actively trading.

What Is a Staking-as-a-service Platform?

Staking-as-a-service platforms are blockchain networks that provide users with the opportunity to stake their cryptocurrencies without having to set up a staking wallet. Unfortunately, these platforms are usually not available for free, which makes it very difficult for everyday cryptocurrency enthusiasts to take advantage of this way of earning passive income. However, it does provide you with all of the same benefits, without having to do any work at all.

7 Best Coins for Staking

Ethereum

Ethereum is an excellent option if you want to stake your coins. It's the second-most valuable cryptocurrency in the world, which means there are plenty of trading opportunities for you to find. Plus, it has a lot of potential for growth over the next few years.

With this coin, you can expect up to an 8.5% return on your staking. In addition, this well-known global payment system can be used for minting new tokens, NFTs, or even global payments. You can start staking ETH with platforms such as Binance, Coinbase, Kraken, eToro, Gemini, and Crypto.com.

Cardano

Cardano, also known as ADA, is a digital coin that was originally created to be a better version of Ethereum, focusing on building a coin that could grow as the platform grew. Plus, the crypto itself can be used to create Dapps, make smart contracts, or even mint crypto tokens as needed.

However, unlike energy problems associated with mining Bitcoin, its proof-of-stake offers a more straightforward solution for this issue. Staking ADA provides the potential to deliver up to an 8.38% return on your invested money. You can start staking ADA with platforms such as Binance, Kraken, eToro, and Crypto.com.

Avalanche

Avalanche or AVAX is a cryptocurrency that is specifically designed to be used as part of a decentralized blockchain application. It can be used to pay transaction fees, create smart contracts with Dapps, and has the most reported validators contributing to the proof-of-stake work.

It's comparable with Ethereum, using an intelligent programming language. With AVAX, you can expect the highest rate of return to be 13.47%. You can start staking AVAX with platforms such as Binance and Crypto.com.

Binance Coin

Binance coin is the official cryptocurrency issued by Binance, the largest crypto exchange in the world. As a cryptocurrency, it has decent prospects for growth as well as large trading volumes. Plus, if you choose to stake directly through Binance, you'll get a discount for paying their fees instead of using an alternative platform.

With Binance coin, you can expect the highest rate of return to be at 8.69%. You can start staking BNB with platforms such as Binance and Crypto.com.

Polygon

Polygon is a token that was created off of the Ethereum network to decentralize game publishers, power micro-transactions, and provide gamers with more power. Polygon is an ERC20 token which means you can stake it using wallets like MEW, MetaMask, or Coinbase Wallet. With MATIC, you can quickly transfer Ethereum into Polygon as needed or vice versa.

With the Polygon coin, you can expect the highest rate of return to be at 14.09%. You can start staking MATIC with platforms such as Binance, Gemini, and Crypto.com.

USDC

USD Coin, also known as USDC, is a stable, fiat-collateralized coin that was created by Circle. This means it's a cryptocurrency that is supported by the US dollar and can be easily bought or sold on most exchanges. It has a high trading volume which makes it an excellent option for staking as you'll have more opportunities to buy and sell, giving you a better return overall. With USDC, you can expect the highest rate of return to be at 2.79%. You can start staking USDC with platforms such as Coinbase or Binance.

Algorand

Last but not least, Algorand (ALGO) is a cryptocurrency that offers high security and scalability with low transaction fees. The coin can be used in smart contracts, creating decentralized applications, or minting non-fungible tokens for its users' projects, allowing many functions to be run through one crypto.

With ALGO, you can expect the highest rate of return to be at 14.47%. You can start staking ALGO with platforms such as Coinbase, Binance, and Crypto.com.

How to Choose a Staking Platform

When you're looking for a staking platform, there are a few things to keep in mind. If you're unsure where to start the process, you'll want to compare each platform against the following factors.

Regulations

The first thing to consider is whether or not your chosen platform is regulated. This will often change how you authenticate yourself and how much information you're required to provide the company with. The regulations will also impact how long it takes to receive your coins after they've been staked.

Reputation

You'll also want to consider how reputable the company is that you're giving your coins to. There are a few different things to look out for, including whether or not the company has been hacked before, how long they've been around, and what other customer reviews are saying about their service.

Fees

Next, you'll want to consider how much you're going to have to pay for staking services. This includes any fees that the company might charge as well as what kind of stake limits they have in place. Fees can vary from 3% to 5%, but there are also companies that don't charge any fees at all.

Payment Methods

The payment methods available can also make a big difference when you're choosing between staking platforms. You'll want to find out if the platform accepts cryptocurrencies like Bitcoin, Ethereum, and Litecoin or if they only accept fiat currency. Can you purchase using cash or with a credit card? Again, it's essential to understand what methods are available to you before purchasing.

Customer Support

Last but not least, you'll want to consider the customer support that each platform offers. This can include having a 24/7 phone support line as well as email and chat-based support where you can talk with someone at any time. There are some staking platforms that even offer online tutorials and FAQ pages to help their customers get the full support that they need.

Read Terms and Conditions

Whether you use one of the staking platforms listed above or another service, it's essential to understand their terms and conditions before you begin. Things are subject to change over time, so be sure that you read them thoroughly before investing any money.

Do Your Own Research

Last but not least, you're going to want to do your own research before choosing a staking platform. You can check out reviews from other customers or even read news articles where companies are discussed in order to make the best choice possible for you and your needs. Then, make sure to pick the right platform for your needs.

Conclusion: How to Start Staking from Scratch

When it comes to staking, there are many different options out there for you to choose from. The best way to find the right staking platform for you is by comparing and contrasting each one and finding the platform that will offer you everything you need at a reasonable price. If you're looking for the easiest way to start staking as a beginner, you'll want to purchase major crypto online or through a crypto ATM and exchange those coins for those that are stake-able.

FAQ

How to stake coins on Binance?

If you want to stake coins on Binance, you need to register on their webpage. Deposit your coins into this account by sending them to your Ether wallet address. Once the transaction has been completed, click the fund's tab and select Deposits Withdrawals. You can then click on deposit beside the coin of choice and copy the address provided there. Transfer your funds to this new address. Now, the transaction has been completed, and you can simply select the BNB coin on their home page and click staking.

What are Coinbase staking rewards?

Staking rewards are the interest, or dividend, that you earn by holding the coin in your Coinbase wallet for a set amount of time. The longer you keep it there, the more you will earn.

Is staking crypto safe?

Staking crypto is generally considered safe. However, as with all crypto transactions, there is always some risk involved. If the digital platform you're staking on is hacked, your money could be stolen or lost. For this reason, it's extremely important that you do your own research before choosing a staking platform and that you keep your funds as secure as possible.

How to stake on a hardware wallet?

Staking on a hardware wallet is extremely simple. All you need to do is download the staking platform onto your device, open it, and follow the instructions. There are some coins that require you to keep them in your hardware wallet for the maximum amount of time possible before they will start staking.