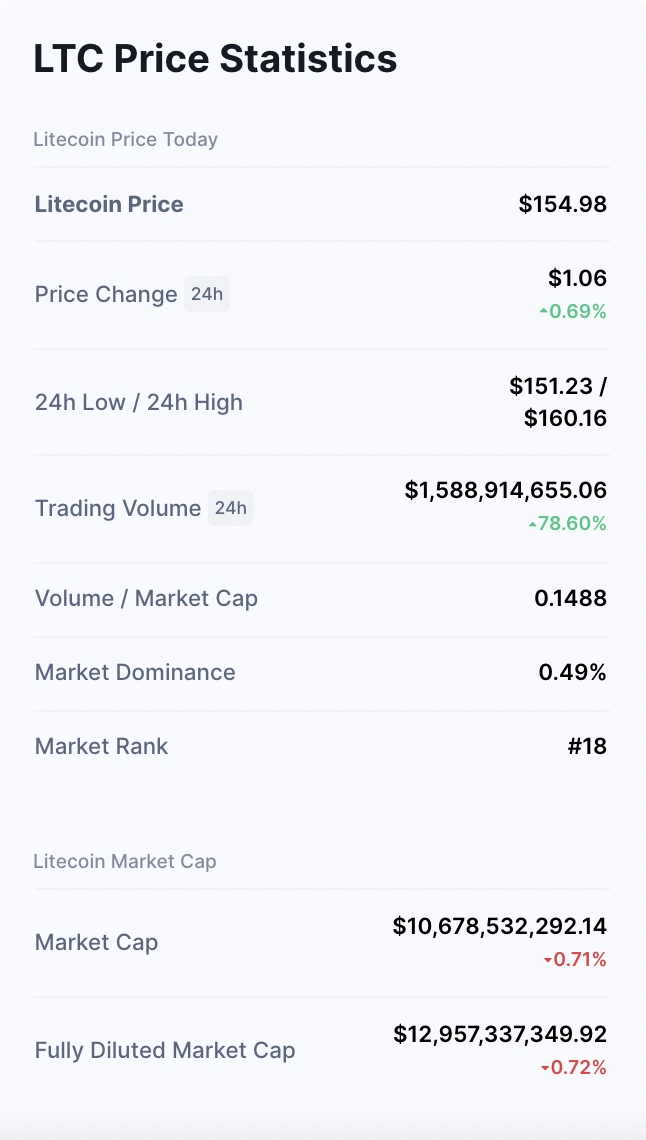

Litecoin is a cryptocurrency that was created with an intent to be the 'silver' to bitcoin's 'gold.' It has since gained a lot of traction and grown significantly in value alongside Bitcoin. It's currently considered the 18th largest cryptocurrency globally, with many projecting it to rise in ranks within the next year.

So, is Litecoin a good investment? Does Litecoin have more room for growth, or will it stagnate like many other cryptocurrencies? In this article, we'll cover everything you need to know about Litecoin and if it's a good investment to make in 2022.

Litecoin Investing: What Is It?

Litecoin was created by Charlie Lee in 2011 and can be identified in the market as LTC. It was intended to be a lighter, faster alternative to Bitcoin with a decreased block generation time and increased maximum supply. Litecoin is similar to Bitcoin in that it is a peer-to-peer digital currency that can be used for payments online. Today Litecoin is still managed by Lee and his team at Litecoin Foundation.

Transactions are verified by network nodes through cryptography and recorded in a public dispersed ledger called a blockchain. Like Bitcoin, Litecoin is also mined. However, it uses the Scrypt algorithm instead of the SHA-256 algorithm used by Bitcoin. This makes it easier for regular people to mine Litecoin than Bitcoin.

What Is Litecoin Used For?

Litecoin is primarily used as a payment method online, providing an easy and efficient way to exchange money for services in the real world. Litecoin can also be used for tipping online content creators, like bloggers and YouTubers, as a way to thank them for their hard work.

Overall, Litecoin was designed to address several problems that are common with Bitcoin, including slower transaction speeds, higher transaction fees, and difficulty fixing the network. By improving upon existing technology, Litecoin became a faster, easier, and more efficient cryptocurrency that could add real value to the world economy.

Litecoin Fundamental Analysis

Litecoin didn't live up to its full potential in 2021, as did other cryptocurrencies like Dogecoin and Bitcoin. While that doesn't mean that it won't happen in 2022, it's worth doing your own research before investing as the market is ever-changing.

Litecoin is still a young currency and has a lot of room to grow. The Litecoin Foundation is constantly working on new projects and innovations to make Litecoin even more accessible and user-friendly.

Lee is also very active on social media, providing updates and answering questions from the community. This level of transparency and communication gives investors confidence in the currency and its growth potential.

However, due to its close relationship with the popular cryptocurrency, Bitcoin, and the fact that there are a limited amount of coins available, it's evident that Litecoin has much room to grow. In fact, daily transactions of Litecoin have consistently hit between 200,000 to 380,000 for the last five years.

Litecoin Technical Analysis

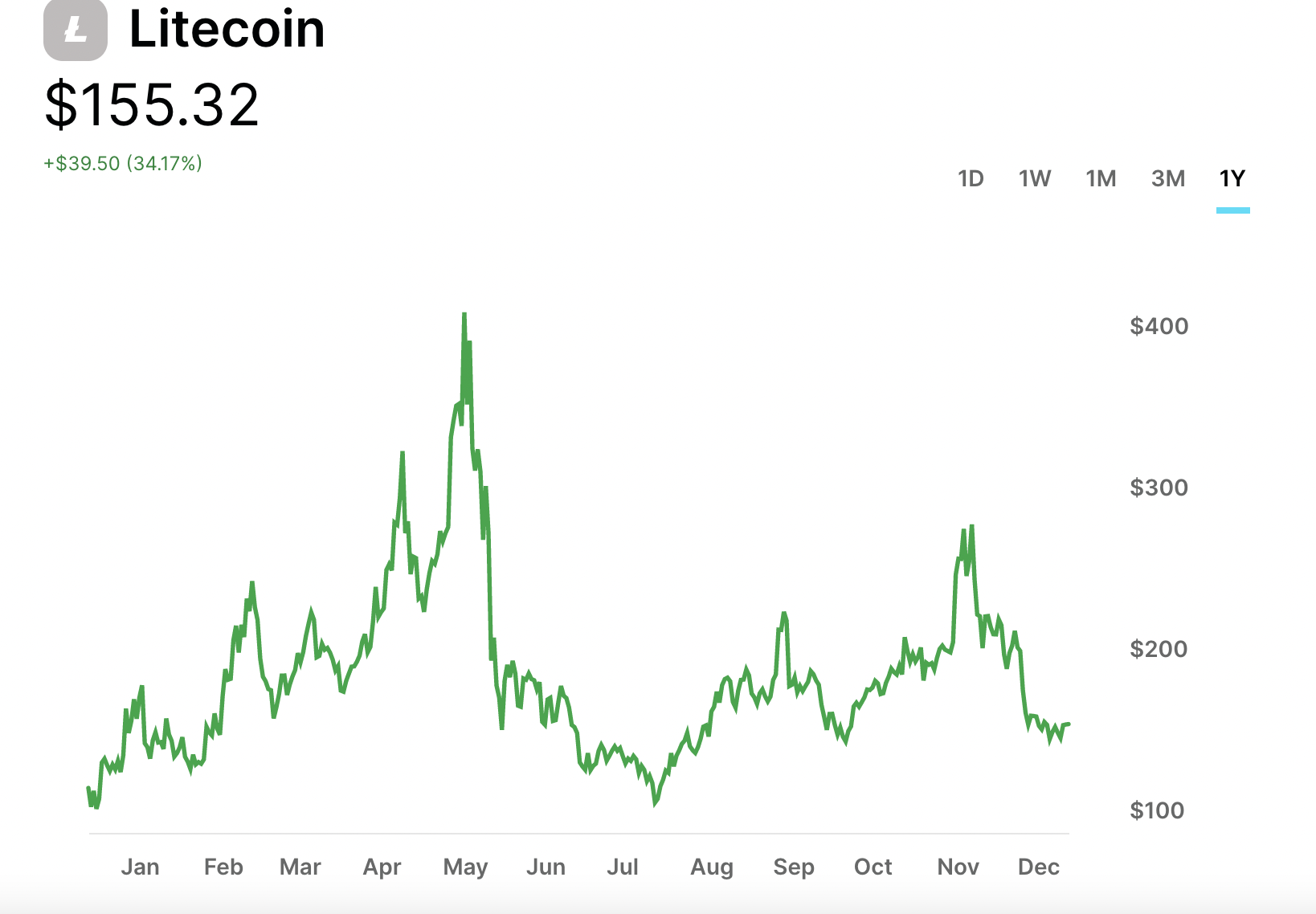

As with any cryptocurrency, Litecoin has seen its fair share of ups and downs. During the beginning of the year, it continued to gradually grow, with tiny dips along the way. LTC reached its all-time high this year in May, hitting a price of over $409 on May 9th for the cryptocurrency.

However, after that spike, LTC continued to keep falling throughout the next two and a half months until it reached an all-time low in July, barely reaching over $100 for the cryptocurrency. Thankfully, for the last few months, we've seen LTC making its way back up again. As of December 20th, the current price is sitting at $155.33, with predictions that it should reach $160 before the end of the year.

Many experts are predicting that just like the last cycle, Litecoin could have a significant margin increase during 2022. This is why Litecoin should be on your watch list as we head into the new year.

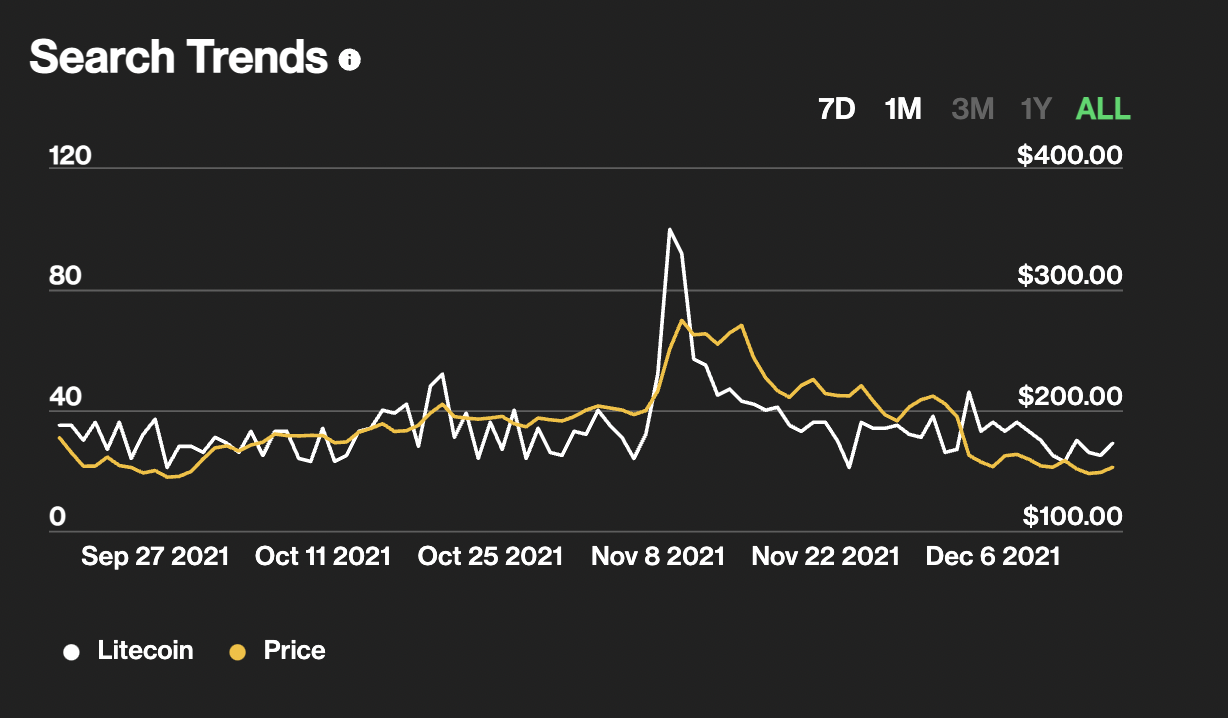

Litecoin Sentiment Analysis

Unlike other popular cryptocurrencies that are consistently mentioned through social media and the news, Litecoin doesn't seem to have the same level of attention and instead has a bearish sentiment. This is especially true because it doesn't rank in the top ten of cryptocurrency, so the mentions of the coin have not been as high in the last few months.

While this could be seen as a bad thing, it may be good for investors. This means that there is less FOMO (fear of missing out) and more room for growth as people begin to learn about the currency and its potential. 2022 could be the turnaround year that Litecoin needs to expand.

Litecoin Price Predictions

Cryptocurrency is always a risky investment, and no one can predict for sure how the market will behave. However, that doesn't mean that we can't make educated guesses about where Litecoin could be headed. Here are three price predictions for Litecoin in 2022 according to longforecast and tradingbeasts:

1. Litecoin will reach a value of $300.

2. Litecoin will become more accessible to the general public, and its daily transactions will exceed 420,000.

3. Litecoin will be used by large corporations as a form of payment as new coin developments are finally released.

Ways To Invest In Litecoin

There are many ways to invest in Litecoin. The easiest way to get started with your Litecoin investment is to either purchase cryptocurrency online or find a Litecoin ATM near you. Once you've purchased your crypto, it's time to choose the best investment strategy for you. Below are the most common strategies you might want to consider for 2022.

Buy and Hold

Probably the most tried and true strategy for investing in cryptocurrency. Buy low, and hold! If you can find a good entry point, buy as much as you can now, and wait. You'll want to allow the coins to sit in your wallet and continue to hold them until it's the right time to sell them.

While this is the most common investing strategy, it's also one of the riskier ones. You might not get a return on your coins, or it may take a very long time before you see any gains from them. For this reason, it's essential always to pay attention to the market and upcoming trends to ensure you're making the right decision regarding your cryptocurrency.

Spot trading

Instead of holding and buying onto an asset, you might instead choose to spot trade. Spot trading is when you buy crypto as it hits a low point and sells it when it hits a high point in order to make a profit.

This can be done through a variety of exchanges. However, the key to making money through spot trading is timing. So, first, you'll need to be aware of changing market trends. Some choose to do this daily, watching for the highs and lows from hour to hour, while others check daily or weekly.

Derivatives trading

Derivatives trading is for those who are more experienced with investing in cryptocurrency. The market is very risky, even at the best of times, but there are ways to protect yourself from these risks by using derivatives trading.

There are various ways you can trade derivatives for Litecoin, including futures contracts and options contracts that allow an investor to hedge their bets against potential losses or gains in the market. So regardless of the way the market turns, you're able to make profits if you predicted correctly.

Where to Invest in Litecoin

If you want to invest in Litecoin, you'll need to open an account on a cryptocurrency exchange, which can be completed with a variety of payment methods. These crypto exchanges allow you to exchange your fiat currency (such as USD) into Litecoin.

Many platforms allow you to do this, which is why it's essential to compare them to find the one that best fits your needs. Here are the top three you should consider for your Litecoin purchase.

Coinbase

Coinbase is one of the most popular cryptocurrency exchanges and allows you to buy Bitcoin, Ethereum, and Litecoin. It has a simple user interface and is one of the most beginner-friendly exchanges available. With more than 37 million users worldwide choosing this platform, it's a great place to start your cryptocurrency investment.

Coinbase is one of the most secure exchanges available, as they store 98% of their assets in cold wallets and offer two-step authentication for accounts. However, Coinbase can be a little pricey as they charge around 2.49% per transaction. If you're only interested in obtaining Litecoin or Bitcoin quickly, this is an excellent option without going through a verification process that leads to higher fees.

Gemini

Gemini is another popular exchange that allows you to trade Litecoin, along with 25 other coins on their network. This platform is an excellent option for those who want to invest in cryptocurrency but don't have much knowledge on how to navigate complicated platforms or processes. Not only does the app feature an easy-to-use interface, but it also features tons of investing tools and news to make it simple to get started with your crypto purchase.

If you only want to buy Litecoin through Gemini, it will cost you 0.5% above the current trading price, as well as a transaction fee based on how much you're purchasing or trading.

eToro

eToro is one of the most popular platforms when it comes to cryptocurrency trading. On this platform, you're able to buy, sell, and trade a variety of different cryptocurrencies. In addition, you're also able to follow other experienced investors on the network and copy their trades in order to make money yourself.

This platform is excellent for those who are just starting out in the cryptocurrency world and want to make some money without learning all the ins and outs of the market. Plus, you can even take advantage of their virtual trading, allowing you to use $100,000 of fake money to learn how to trade.

Factors Of Choice Brokers

Before choosing one of the above brokers, or any other broker, it's essential to compare different factors in order to make the best decision for yourself.

Coin access

First, you'll want to ensure that the broker you're considering allows access to the coin you want to purchase. For example, some online platforms only allow access to Bitcoin, Ethereum, and Litecoin, while others, like Gemini, allow investors to buy 25 different cryptocurrencies.

Besides having the crypto you want available, you'll also want to ensure that you have easy access to the coins you've purchased so that it's easy to move, trade, buy, or sell as you want.

Trading platform

Second, you'll want to look at the trading platform that the broker is using. If you're a beginner, then you'll want to find an exchange that has a user interface that is easy to use and understand. On the other hand, experienced traders might prefer exchanges with more features, like stop-loss orders or margin trading.

Fees and commissions

You'll also want to consider the fees and commissions associated with each platform. For example, some exchanges charge more for transactions, while others charge withdrawal fees. While this might not seem important, these fees can quickly add up, especially if you choose to invest or trade large amounts of money.

Advantages of Litecoin Investments

There are many advantages to investing in Litecoin. Some of these benefits include:

Lower transaction costs

Since Litecoin is a fork of Bitcoin, the two cryptocurrencies share many similarities. One of these similarities is the lower transaction costs when compared to other altcoins. This is because Litecoin uses a faster, more efficient network, meaning that you won't have to pay much money when you receive or start a transfer. Litecoin is an excellent option for merchants or individuals who regularly make transfers and can save them a ton of money in fees.

Faster transaction speeds

The faster transaction speeds of Litecoin make it an excellent choice for those who want to use cryptocurrency for everyday transactions. For example, if you're buying goods or services online, you'll be able to complete the purchase in a fraction of the time it would take with Bitcoin.

Open-source platform

Due to the accessibility of the open-source platform that Litecoin was built on, it's become more popular than other cryptocurrencies. This is because developers and individuals who want to adjust and make improvements to the platform can do it without having to learn a new or complicated system, which has led to faster transaction speeds, lower costs, and better overall functionality of the coin.

Recognizability

Litecoin is also one of the most recognizable cryptocurrencies on the market. This is because it was one of the first to be created and has been around for longer than some of the other altcoins. Because of this, more businesses are beginning to accept it as a payment option, making it easier for you to use your coins for everyday transactions.

Disadvantages of Litecoin Investments

While there are many great reasons to invest in Litecoin, there are some disadvantages you should also be aware of before investing in the coin.

Competing altcoins that offer similar benefits

Since Litecoin is one of the older altcoins available, there are a ton of newer and competing cryptocurrencies that offer similar benefits. This means that if you're looking for a specific benefit, like fast transaction speeds, you might find another altcoin that does it better than Litecoin.

Less Security

Litecoin is less secure than Bitcoin. This is because it was initially designed to be a faster and less expensive alternative to Bitcoin. Because of this, it doesn't have the same level of security features that Bitcoin does. So if you're looking for a highly secure cryptocurrency investment, Litecoin might not be the best option for you.

Shaky faith in leadership

While Litecoin has a great community and real potential for growth, there is sometimes criticism of the team that develops the coin. Some critics claim that the leadership and developers of Litecoin don't do enough to grow or support the community around it, which can make it challenging to trust in their future.

Is Litecoin Better Than Bitcoin?

The short answer is not yet. While Litecoin has a ton of potential to be better than Bitcoin, it's lost a lot of its popularity from when it was first released in 2011. Bitcoin is still leading the way when it comes to cryptocurrency.

However, Litecoin is not out of the running just yet. It still has made many improvements, becoming more efficient for everyday transactions due to its lower fees and faster transaction speeds. As a result, there is much room for Litecoin to grow, and it's still a great option for those looking to invest in cryptocurrency.

FAQ

How much to invest in Litecoin?

There is no set answer regarding how much you should invest in Litecoin. It really depends on what you're hoping to get out of the investment and how confident you are in the coin's potential.

What is the minimum to invest in Litecoin?

There is no set amount that you need to invest in Litecoin. This is because, as we said above, you can buy any fraction of a coin, and your investment will still go up (or down) based on the value of the coins.

Should I invest in Litecoin right now?

It's always difficult to say whether or not you should invest in a particular coin. However, Litecoin is still a great investment option with a lot of potential for growth in the future. So, if you're looking for a long-term investment, Litecoin might be a good option for you.

Does Litecoin have a future?

Yes, Litecoin does have a future. While it may not be as popular as Bitcoin right now, it has still made many improvements and is an excellent option for those looking to invest in cryptocurrency.

How many Litecoins are left?

Ultimately, only 84 million Litecoins will ever be around. As of November 2021, 69 million LTCs were currently in circulation.

Is Litecoin a dead project?

This is unlikely. While Litecoin may seem like a dead project, it's still around and not going anywhere anytime soon. Much of the criticism it has received in the past was due to its lack of growth or support for the community over time, but this seems to have changed within the last year.

Is Litecoin inflationary?

No, Litecoin is not inflationary. The total number of coins that will ever be in circulation is capped at 84 million, and the coin is designed to be deflationary. This means that each coin's value will go up over time (assuming the cryptocurrency remains popular).

Does Litecoin have a limit?

Yes, Litecoin has a maximum limit of 84 million coins.

Why is Litecoin valuable?

Like most cryptocurrencies, Litecoin is valuable because it's decentralized and not controlled by any one entity. This makes it ideal for those looking to invest in an alternative form of currency that isn't tied to the traditional banking system. Additionally, Litecoin has a lot of potential for growth in the future, making it an excellent option for those looking to invest.

What is Litecoin worth in 2025?

This is impossible to say. The value of Litecoin can go up or down based on many factors, including global demand and supply. Therefore, it's always tricky to predict what a particular coin will be worth in the future. However, Litecoin has a lot of growth potential and could be worth more in 2025 than today.

Is there a fixed amount of Litecoin?

Yes, the total number of coins that will ever be in circulation is capped at 84 million.