Bitcoin is a digital currency that has recently exploded in popularity. You can purchase items with it, trade it for other currencies, or even use it to buy stocks and shares.

It's also an extremely volatile asset; the price of Bitcoin can change by $1,000 in either direction over the course of a few hours. However, a great way to make extra money with Bitcoin without purchasing cryptocurrency is through the process of shorting Bitcoin. In this article, we'll cover everything you need to know about what shorting Bitcoin means and how you can do it yourself.

What is BTC Shorts?

The idea behind shorting Bitcoin is that you believe there will be a decrease in the value of Bitcoin. So, instead of buying Bitcoin and waiting for its value to increase, you borrow Bitcoins from a broker and sell them at the market rate. From there, you hope that the Bitcoin will decrease so that you can repurchase the Bitcoin at a lower price and give it back to the lender. When you hand it back over, you get to keep the difference in price between what they paid for it and what you sold it for.

For example, let's say that you want to short Bitcoin when the price is $500 for 1 Bitcoin. You'll go to a lender and borrow that Bitcoin. Then, you'll sell it on the market to make $500. At that point, the price of Bitcoin will either go up or go down. Let's say the price of Bitcoin decreases to $400. You would then repurchase the Bitcoin, give the Bitcoin back to the person you borrowed it from, and keep the profit of $100. However, if the Bitcoin price had increased to $600, you would have lost $100 in the trade.

Longs vs. Shorts - The Key Differences

The biggest question that most people have when it comes to trading is determining whether they want to go long or short. While they both represent making money, they're done in two very different ways. Short positions are usually placed in bearish markets with the hope that the market will decrease in value so that you can buy back the same crypto but at a significantly lower rate. Long positions are when you purchase at a low market price and hold on to the cryptocurrency until it reaches peak pricing.

Shorting BTC Example

When you are shorting BTC, you'll be selling your Bitcoin at an all-time high and repurchasing once the price decreases. For example, if your 1 Bitcoin is valued at $1,000 and you sell it, you're hoping that the market price will decrease. Once it hits $800 for 1 BTC, you're able to repurchase the same amount of Bitcoin while retaining the $200 profit.

Longing BTC Example

Longing BTC is the complete opposite. In this scenario, you will hold on to a low-priced BTC until it raises in value. For example, let's say that you purchase 1 BTC for $1,000. You'll hold on to the Bitcoin until it reaches a higher value, such as $1,500 for 1 BTC. At that point, you'll sell off your Bitcoin and rake in the $500 profit.

Is it Profitable to Bet Against Bitcoin?

Yes, it can be profitable to bet against Bitcoin as the price is extremely volatile. In fact, you could make a lot of money if you shorted BTC at its peak value on April 14th, 2021, when it hit an all-time high of $64,863 for one coin. If you had shorted those levels and bought back in after the price decreased, you would have been able to profit from the lowering price. However, as with any type of trading, the market doesn't always work out the way you had hoped.

Pros of Shorting

Some of the pros of shorting include:

- High Leverage: In the world of cryptocurrency, you can get a lot more bang for your buck when it comes to shorting. For example, if the price decreases by $100 per coin and you have 100 coins worth $1000 total, you'll be able to make so much money that it becomes almost too good of an opportunity to pass up.

- Low commission fees: There are low commission fees associated with the trade when you short Bitcoin. You'll also be able to make a lot more money on your transactions when it's not being taken away by third-party exchanges.

- Increase Profits: You can make a lot of money when you short Bitcoin, especially if the market tanks. This is because it allows you to capitalize on the price drop and increase your profits considerably.

Cons of Shorting

- No guaranteed profits: Just like with longs, there's no guarantee that you'll make money when shorting. The market is highly volatile, and it could continue to go up without any signs of slowing down or going back.

- The Danger of Margin Trading: The danger lies in how much leverage you have on your trades when you're shorting Bitcoin. In other words, with high leverage comes a lot of risks as you could lose so much money that it becomes impossible to recover.

- Short Squeezes: A short squeeze is when many traders are betting against the market, but it starts to turn around on them. If you're unable to cover your position because there's not enough supply at that price point, you'll be forced out of your trade and lose money.

How to Short Bitcoin in the Most Effective Way?

If you want to start getting in on the action, you'll want to make sure you have the right strategy before getting started. So here's a step-by-step guide to getting started today.

1. Understand What Influences The Market

The first step is to understand what influences the market. If you're unable to keep up with trends that impact cryptocurrency prices, you won't be able to determine when you should jump in. Whether you start with Bitcoin or other cryptocurrency types, you'll want to understand how politics, news, or any other factors impact the overall price of your BTC.

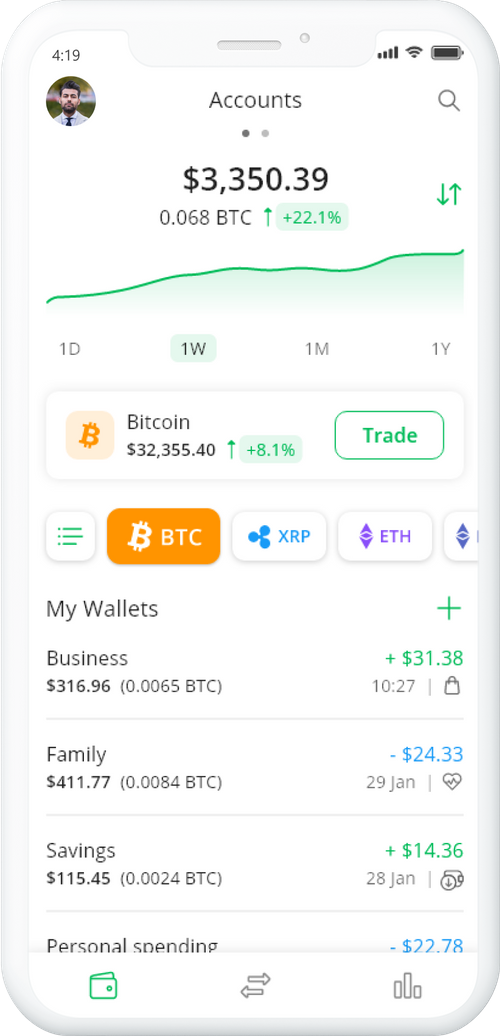

2. Open Your Trading Account

The next step is to open your trading account. If you're confident in the strategies you'll use, opening an account shouldn't be a problem as they are all available online now. You can quickly and easily set up your own account without any issues or delays from third-party exchanges. However, it's essential to check the exchange to ensure they allow short selling and that your countries regulations will enable this type of trading.

3. Create Your Plan

Do you know what limit you're willing to lose if the market falls? Make sure you create a plan of how much you plan to invest, what your loss limit will be, and how long you're willing to hold on to your cryptocurrency. Once you have a plan created, it's time to watch the market for the right time to short crypto.

Top 4 Strategies to Short Bitcoin

As the popularity of cryptocurrency continues to increase, so do the ways that you can short Bitcoin. In this portion, we'll highlight the top strategies you can use to go about shorting your Bitcoin.

1. Margin trading

One of the easiest ways to short Bitcoin is to use margin trading. You can borrow money from a third-party exchange and make trades as you usually would, with the added bonus of leveraging your position significantly. However, this comes at a cost - if the price goes up unexpectedly or doesn't go down fast enough, you could lose an exorbitant amount of money that makes it impossible for you to recover. Regardless, this is one of the more accessible options if you're unable to put your own money on the line.

2. Futures trading

If traditional short selling isn't quite for you, other opportunities are available, such as going after Bitcoin futures instead. In this case, all traders have to do is purchase the crypto with a contract, specifying the date and the price it will be sold for. When you buy this type of contract, you believe that the cost of BTC will rise. If you're correct, you end up making a significant amount of money later on. However, if you instead decide to sell futures contracts, you believe that the value of Bitcoin will decrease at a later point.

3. CFDs

A contract for differences is between two people that specify they'll pay the difference in value if one party is right about a specific investment. In this case, you will either need to have your Bitcoin returned or be paid by another trader for any loss incurred during the process. While it does require some money at risk from both parties, CFDs are more accessible than traditional short selling due to their nature and often come with low fees. It can be compared to Bitcoin futures because the idea behind it is to bet on the Bitcoin price and how it will fluctuate.

4. Short Selling Bitcoin Assets

The idea behind short-selling is to sell your own tokens for cash and wait until the price drops to purchase them back. However, this is the riskiest of all the methods because there's no guarantee that you'll receive back the crypto that you originally bought at a better value. In fact, you could even end up losing money on your assets throughout the process. So while this is a simple way to short Bitcoin, it's the least popular for most investors.

When to Short Bitcoin

Knowing when to start shorting Bitcoin is essential for your own success as a trader. If you're too early, there's no way to recover from that, and if you wait too long, chances are the price will increase before you can make any money off of it at all. The best times to short BTC depend on what type of trading strategy you want to use, but generally speaking, it's better to be more aggressive during bearish trends while being more patient with bullish ones. A few tips to make sure you pick the right time to start includes:

- Watching The Market Mentality: Frequently, the best time to start shorting BTC is right after a massive price increase. If you notice that everyone and their mother are all talking about how great Bitcoin is doing on social media, it's probably not going to be long before its value tanks again. This is because the market tends to follow specific cycles. By understanding what those cycles are, you're able to determine the best time to short Bitcoin.

- Watch Technical Analysis: When using technical analysis for quick selling purposes, look at things such as support lines and resistance points in order to get an idea of where these assets will go during different trends. This can help you avoid specific scenarios while also giving you more leeway with your losses if something does happen.

- Look At The News: It goes without saying, but when there's big news surrounding cryptocurrencies or decentralized blockchain technology in general, it could directly impact prices. Keeping your ear to the ground is essential during these times, especially when it's clear that popular opinion on Bitcoin has changed.

- Be Patient: As tempting as it might be, don't make rash decisions with short selling because you could end up losing money if prices go in an unexpected direction before taking another step. Being patient can help keep things even more under control and avoid unnecessary risks throughout the process.

- Understand Past Bitcoin Short Success Stories: Look at how some of the best traders in the world do it and study their methods. This can give you a leg up on your competition while also helping to make sure that short-selling strategies are carried out correctly and with complete knowledge about what's going on throughout this process.

How To Avoid The Risks Of Shorting Bitcoin

With any great opportunity, there are always risks associated with it. Shorting Bitcoin is no different because you're essentially taking a gamble on the price of this asset fluctuating to your favor before changing again. Unfortunately, if you aren't careful, following these steps could lead to some bad results that might actually end up costing you money rather than making any gains through short selling strategies:

Don't Over-Trade: This is one of the most common mistakes made by newbie traders and happens when they think more about how much profit they can make each day rather than what's best for their long-term success in trading cryptocurrencies. While profits are good, overtrading can cause problems too, which means learning moderation skills becomes essential during this process.

Over Leverage Your Positions: Leverage can be a great thing for some people, but if you aren't careful, it could end up causing more trouble than good. Sometimes, trading too much with borrowed money leads to significant losses and even bigger problems later on. It's best to avoid this scenario entirely by using the 50:25:25 rule, which means never putting more than fifty percent of your entire account into any single position at one time.

Not Working With A Professional Platform: If you want to get started short-selling Bitcoin (and other cryptocurrencies), finding a quality platform that helps make things easier along the way becomes essential as well. Working alongside experts who understand how this works is often preferable because they'll know what strategies work best during different market situations instead of blindly trusting an unprofessional platform.

Tax Management

A critical part of trading Bitcoin is the fact that it's taxed just like every other asset out there. When you sell Bitcoin for a profit, you're legally required to pay capital gains on any profits made along the way, which can impact your bottom line later on.

While being aware of tax management rules isn't necessarily fun, it does become important during certain parts of short-selling strategies because failing to follow them could mean some unnecessary problems down the road. It's best to work with professionals who understand crypto taxes so everything gets adequately calculated without having too much or too little taken off what should be paid to stay within legal boundaries and avoid future penalties.

Which Exchange to Choose?

The final step to getting started with shorting BTC is to choose the proper exchange. It's important to note that not every exchange will allow short selling on their platform. This is why it's essential to understand the platforms that will enable it and how to pick the right one for your needs. The top platforms to check out include:

Binance Short Selling

Binance is one of the top cryptocurrency exchanges on the market today, so it makes sense that they would allow short selling as part of their services. They've become popular because not only do they offer a large number of different currencies to trade with, but they also have low fees and reliable platform security, which is always essential for traders who want to minimize any unnecessary risks along the way.

BitMEX Short Selling

Another great option is Bitmex. This exchange has earned its reputation over time because it's 100% crypto-focused (no fiat currency) which helps make things easier for users. Fees are more expensive than some other platforms out there but still less than what you'd find elsewhere around town too. Overall, if you know how to use Bitmex, it can be an excellent option for traders looking to short Bitcoin on their own.

Shorting Bitcoin on GDAX / Coinbase Pro

For those who want to short Bitcoin on an exchange with a more familiar name, Coinbase Pro (formerly known as GDAX) is the platform that you'll need. This is where many new cryptocurrency users start by buying their first coins, and it's also one of the places where they can learn how to sell later on if needed. Fees are low, but withdrawals require ID verification which means this isn't necessarily for traders looking for something fast and easy without jumping through hoops along the way.

Kraken

Kraken is another solid option for short-selling Bitcoin. They have a large selection of different cryptocurrencies to choose from, and fees are pretty low. However, withdrawals aren't instantaneous, so it's essential to keep that in mind during this process. Overall, Kraken can be an excellent platform for traders looking to get started with BTC shorts. Still, the ease of use might not necessarily make this one worth going back to after trying something else instead down the line since there's no mobile app either.

Where to Buy Cryptocurrency to Start Shorting

Before trading, you're going to need to purchase the actual cryptocurrency that you want to short. This means finding an exchange where it's possible to buy the coin in question before getting started with this process. There are a few different ways you can do this, including:

- Purchasing Through a Bitcoin ATM: If you have cash that you want to turn into cryptocurrency or simply wish to purchase in person, Bitcoin ATMs provide a simple solution. Check out our step-to-step guide on using PayDepot's Bitcoin machines.

- Buying Online: If you don't want to leave the comfort of your own home, consider purchasing your Bitcoin online. It's simple, takes a short amount of time, and the best part is that you don't have to go anywhere or talk to anyone to buy it!

F.A.Q.

Can Bitcoin be shorted?

Yes! It's possible to short Bitcoin by selling coins that you already own or coins that you're borrowing.

Is short selling more profitable?

Not necessarily. Short selling can be profitable, but it's also risky at the same time, so you need to make sure that you understand how to do it and have a strategy in place.

Is short selling ethical?

It depends on your perspective and the current market conditions. But generally speaking, it's considered an ethical practice to manage risk by shorting Bitcoin when you think that its value will decrease.

What is the long/short ratio?

This is how many long or short positions that a particular exchange has open at any given time.

Is Leverage Trading Regulated?

Yes, although some countries don't require it to be. Some exchanges (like BitMex) allow traders to use leverage trading, which means borrowing additional coins to increase your buying power or selling off extra coins if you're shorting.