If you've heard about Ethereum, chances are you've heard about the token: Ether (ETH). ETH is the second most popular cryptocurrency in the world by market cap after Bitcoin. It's very similar to BTC, but it has many advantages, including faster block times and lower fees.

Ethereum even has its own ecosystem of tokens, which are considered so-called ERC-20 standard tokens. These are fully-fledged digital assets that work on top of the Ethereum blockchain. In this article, we'll explain what wETH is and how you can trade your ETH for other ERC-20 tokens.

What Is Wrapped Crypto?

In their simplest form, wrapped crypto tokens are coins that are associated with the value of another crypto or any other type of assets such as real estate, shares, stocks, or even gold. The original crypto is "wrapped," which means it's put into a digital vault and transformed into a new token that can be used to trade against other crypto assets.

Wrapped crypto can be used to represent anything from crypto assets and stocks to collectibles and arts. However, since they are connected with another asset, they have to be managed and taken care of by another entity that will unwrap and wrap the asset as necessary.

Why Wrap ETH?

When you choose to wrap ETH, you're essentially creating a new token that is tied to the value of ETH. You can then trade this newly-created digital asset similar to how you would trade any other tokens on an exchange, which means you can buy or sell these wrapped tokens for your desired price. Plus, you can use your wrapped ETH for transactions within the DeFi ecosystem or any other Ethereum network decentralized application.

ETH vs. wETH

ETH and wETH are the same crypto, but they function a bit differently. wETH follows a ERC-20 standard, which means it has a single layer of fungibility. On the other hand, ETH is used to power smart contracts, and it also functions as an intrinsic value token itself. So, when using wETH, your tokens become usable on a broad spectrum of dApps and allow you to use them across DeFi applications.

Advantages of Wrapping ETH

There are many advantages to wrapping ETH. First, you get the ability to send and receive ETH like you would any other cryptocurrency. You can also transfer ERC-20 tokens inside a smart contract to someone else using wETH. And because all transactions are within the Ethereum ecosystem, your token will stay worth the same amount of money, allowing you to quickly unwrap and wrap your crypto as needed.

Disadvantages

Due to the fact that the original asset is "locked away," you'll need to have someone who can manage the wrapped assets. Unfortunately, this means that a custodian will have to manage your crypto assets, which can be a disadvantage for some.

How to Convert ETH to wETH

If you want to trade your ETH for other ERC-20 tokens, you'll need to wrap it first. In order to do this, simply follow the following four steps.

-

Ensure You Have a Self-Custody Wallet

To prevent stealing, your wallet should have a private key that you can use to access it. Of course, you'll also need control over the keys, which means that it's best if you don't store them on an exchange.

-

Buy ETH and Transfer to Your Wallet

Next, you need to buy ETH. You can do this either through an exchange or through an ETH ATM. Once you have your ETH, transfer it into your wallet by clicking the 'Receive' tab on your wallet.

-

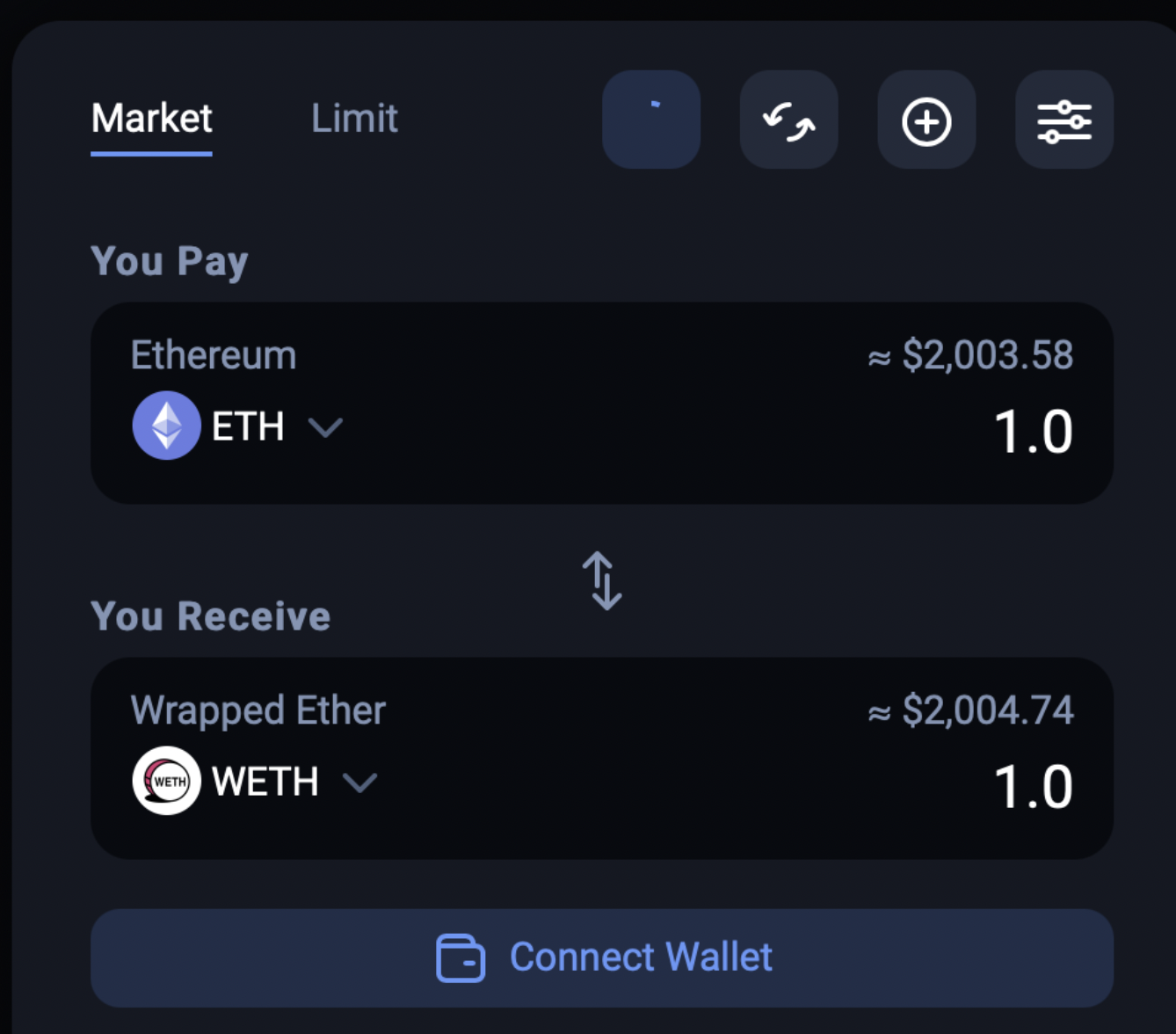

Use ETH to Buy wETH

Next, you'll need to use your ETH to buy wETH. For that, you can type 'wETH' in the search field on the platform that you're using. The easiest way to do this is by using an open order for instant swaps. Fill out the form with the amount of ETH you want to convert, and the network will complete the process, leaving you with wETH.

How to Unwrap ETH

In order to unwrap ETH, you'll need to initiate within the platform of your choice. This is usually as simple as clicking "unwrap" in the exchange you're using. This will transform it back to ETH.

Where to Buy Wrapped Ether

You can use a variety of exchanges to buy wrapped Ether, including Uniswap, PancakeSwap, TraderJoe, and Coinbase. If you're using a different exchange, check first to see if they allow these types of transactions.

Key Takeaways

While ETH and wETH may seem like the same thing, there are some key differences that you need to be aware of before using this type of digital asset. Wrapped Ether is a digital token that's tied to the value of ETH. This allows it to be used across DeFi applications and other decentralized networks. However, due to the way that it's created, you need to use a custodian who can manage your wrapped ETH. If you're looking for a new way to invest and use your crypto, wETH may be the right option for you. Get started by purchasing your ETH today.

FAQ

1. How much is wETH?

wETH is the same as ETH, meaning that the price of an individual token will follow the value of ETH. You'll need to pay the processing fees as required per the platform you use.

2. Is wETH the same as Ethereum?

While they are both derived from the same token, they function a bit differently. wETH is an ERC20 token, but it cannot be traded for ETH on a decentralized exchange. However, you can trade wETH for other ERC-20 tokens though you'll need to use a custodian to manage the process.

3. How to store wETH?

Because wETH is an ERC20 token, it can be stored in various places. This includes wallets that support ETH as well as decentralized exchanges. In most cases, you can store wrapped ETH anywhere where you would typically store ETH.