OTC market (Over The Counter market), or OTC market. Transactions in the OTC market take place outside of regulation or outside of exchanges.

Transactions are made over the telephone, computer networks, and other data transmission methods. Most OTC transactions are concluded through trade organizers, but unlike on-exchange trading, in the OTC market the organizer is not liable if one of the participants fails to perform.

Well-known exchanges

The best-known exchanges are the automated quotation system.

National Association of Securities Dealers (Nasdaq Composite), trading platforms on the basis of Bloomberg information system, for instance, Tradebook FX platform for currency trading.

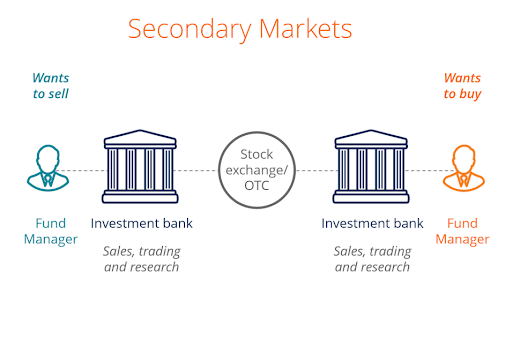

Scheme of interaction between buyers and sellers in the OTC market.

Advantages of the OTC market.

What is good about OTC trading?

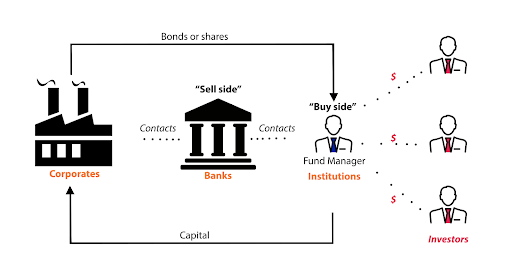

What is the attraction of the OTC market? First of all, it's non-standard lots, commissions, regulation... We often hear that Warren Buffet bought a share in Kraft Heinz for $7bn, Abramovich bought a controlling interest in Chelsea Sports Club for $10bn, or Prokhorov sold a share in Norilsk Nickel for $3bn.

How do such deals happen? If such a volume is brought to the exchange, it will cause the asset to rise or fall by a significant amount. Such non-standard lots are sold or bought on OTC platforms by one investor or a pool of investors into cryptocurrencies. The price of the transaction is usually oriented to the exchange price. But it can also vary quite substantially, by 10 percent, depending on the economic situation.

OTC cryptocurrency market and OTC cryptocurrency trading.

The same thing happens in the cryptocurrency world. There are information systems that receive data on lots, counterparties agree on terms and make a deal. The most popular ways of OTC trading of crypto-assets:

- Making trades through professional intermediaries. Still considered one of the most commonly used. A broker specializing in large transactions acts as an intermediary in such transactions. Information platforms allow you to set different parameters, so that you can find the best suitable seller or buyer of certain tokens.

- Concluding transactions through specialized chats. It is interesting to note that the first over-the-counter transaction in the history of the cryptocurrency market was concluded in a specialized chat room Bitcoin-otc. The largest, oldest and most popular service for OTC cryptocurrency transactions is LocalBitcoins.

- Making a purchase during a token offering (ICO, initial coin offering, or IEO, initial exchange offering). The transactions are made without any intermediaries using smart contracts. When you buy large amounts of tokens you can expect to receive a significant discount.

- Conclusion of transactions through the "dark pools". It is important to note that the majority of the specialized exchanges have special closed sections, which only large investors can enter. In these sections, large investors have the opportunity to buy and sell large volumes of bitcoins, without placing bids on the exchange and without scaring small investors.

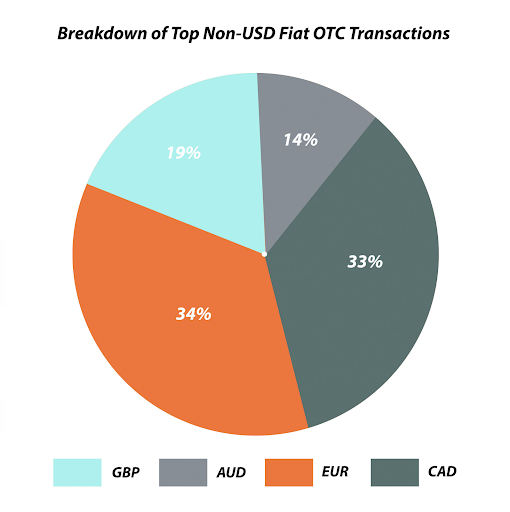

- Concluding transactions via exchangers and crypto ATMs (or crypto machines, such as those of the decentralized cryptocurrency exchange. In the crypto world, there is a specific need for over-the-counter transactions in crypto-fiat transactions. Many companies declare the possibility to buy or sell cryptocurrency with a plastic card. But in many countries for such buying and selling, even if they are not directly prohibited by law, they can either limit the amount of transaction or block the card. That's where the exchangers come to the rescue. And counterparties transfer fiat money to each other separately from crypto assets through over-the-counter platforms.

Bloomberg journalists analyzed the OTC market and found that hedge funds and other financial institutions prefer to buy and sell cryptocurrency through private transactions rather than on cryptocurrency exchanges. Another specificity of the crypto world is that large financial institutions are attracted by the ability to buy "pure" bitcoins, which have never been used in criminal activity, on the OTC market. According to hedge fund Ikigai, individual investors can pay 20% more for such coins than regular coins.

Conclusion

In conclusion, I would like to point out that any trade carries risks. On cryptocurrency OTC market the most acute issue is trust and integrity of intermediaries (brokers, exchangers...), who check counterparties and help to avoid unintentional participation of client in doubtful or criminal operations. And, if the "white" services level out such risks by a thorough KYC (know your customer), the clients of the gray segment of OTC market, which is outside of the regulators' control, have to act at their own risk.

On the other hand, gray OTC platforms are not subject to regulatory sanctions. There is a good example - in 2018, China along with the ICO (Initial Coin Offering), banned the operation of cryptocurrency exchanges, but the restrictions did not greatly affect the functioning of the gray OTC market.